White Paper | 2025

COMMISSIONED BY RETAIL IQ

Unlocking Growth and Profitability for Dispensaries Through Credit Card Acceptance

EXECUTIVE SUMMARY

Cannabis dispensaries in the U.S. have long been constrained by limited payment options. With federal regulations restricting traditional banking relationships, most dispensaries have relied on cash and cashless ATM debit systems. While functional, these options create friction for customers, increase operational risks, and can be expensive for consumers if they incur multiple processing fees.

As consumer expectations evolve, the ability to accept credit cards represents a transformative opportunity for dispensary operators. This paper examines the benefits of adding credit card processing, including revenue growth, enhanced customer loyalty, improved operational efficiency, and a safer, more professional retail experience.

15,000+ dispensaries operate in the U.S., with more states approving recreational and medical cannabis each year.

75%+ of consumers prefer using cards over cash for purchases over $50, yet dispensaries remain cash-heavy.

Competing industries (hospitality, QSR, specialty retail) have already proven that multi-channel payment options drive higher basket sizes and repeat visits.

Market Context

Benefits of Accepting Credit Cards

Increased Sales and Higher Average Ticket Size

- Consumers spend 20–30% more when using credit cards compared to cash.

- Ability to up-sell premium products, accessories, and wellness add-ons when friction is removed at checkout.

- Customers are less price-sensitive when they can use credit instead of carrying limited cash.

Increased Sales and Higher Average Ticket Size

- Consumers spend 20–30% more when using credit cards compared to cash.

- Ability to up-sell premium products, accessories, and wellness add-ons when friction is removed at checkout.

- Customers are less price-sensitive when they can use credit instead of carrying limited cash.

Operational Efficiency

- Reduces cash handling, shrinkage, and theft risk—major concerns in high-volume dispensaries.

- Streamlines reconciliation and reporting with automated card transactions instead of manual cash counts.

- In some markets, lowers insurance premiums and armored car costs are associated with high-cash operations.

Safety and Risk Mitigation

- Reduces the risk of robbery and internal theft by limiting on-site cash.

- Aligns dispensaries with broader retail security practices.

- Improves regulatory and community perception by demonstrating safer business practices.

Financial Growth and Competitive Advantage

- Access to new customer segments who

- avoid cash-heavy businesses.

- Creates alignment with mainstream retail best practices, supporting partnerships, franchising, and multi-site scaling.

- Attracts investors and lenders who value businesses with diversified, stable payment streams.

Addressing Industry Concerns

- Compliance & Legality:

- While federal banking regulations create barriers, compliant providers exist in the high-risk payments space.

- Best-in-class credit card solutions operate through transparent, regulator-approved frameworks.

Costs vs. ROI

- While credit card fees may range from 3–6% per transaction, the revenue lift from higher sales, reduced cash expenses, and increased safety far outweighs processing costs.

- Dispensaries can structure “cash discount” or “convenience fee” programs to offset transaction fees.

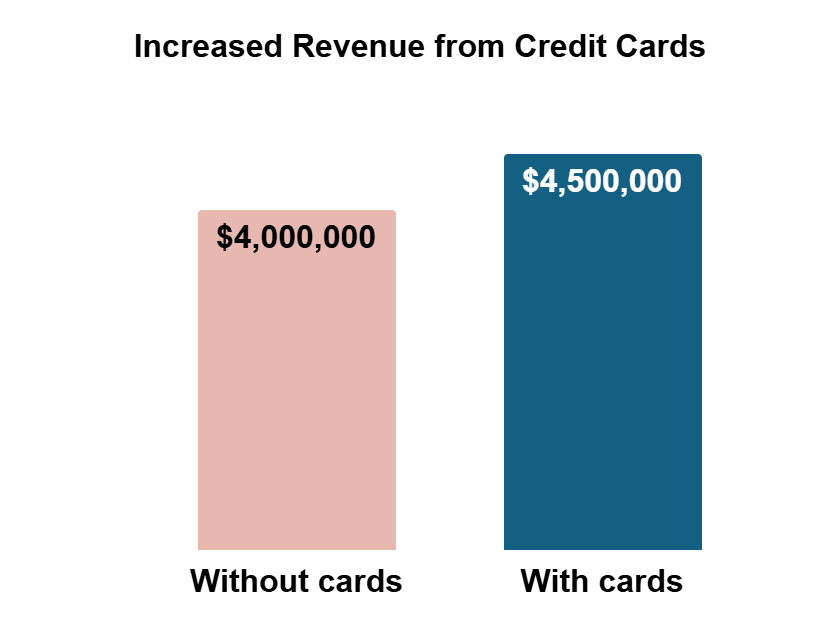

Case Example (Modeled)

Dispensary with $4M annual revenue

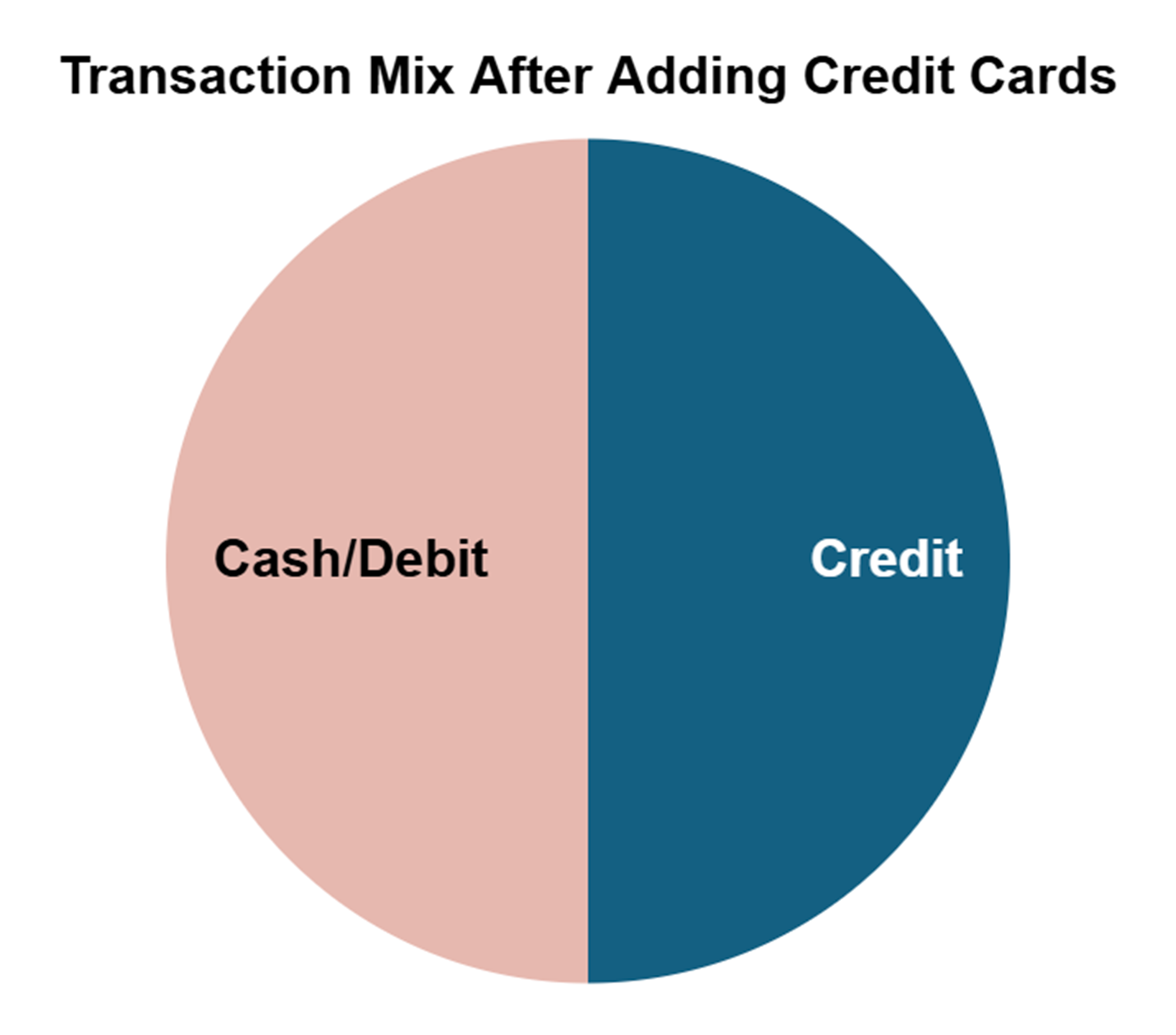

With 50% transactions shifting to credit:

Avg. ticket size with cash/debit: $55

- Avg. ticket size with credit: $66

- Revenue uplift = $500K/year

- Cash-handling expense reduction = $10K/year

- Net ROI even after card fees = >$550K annually

Conclusion

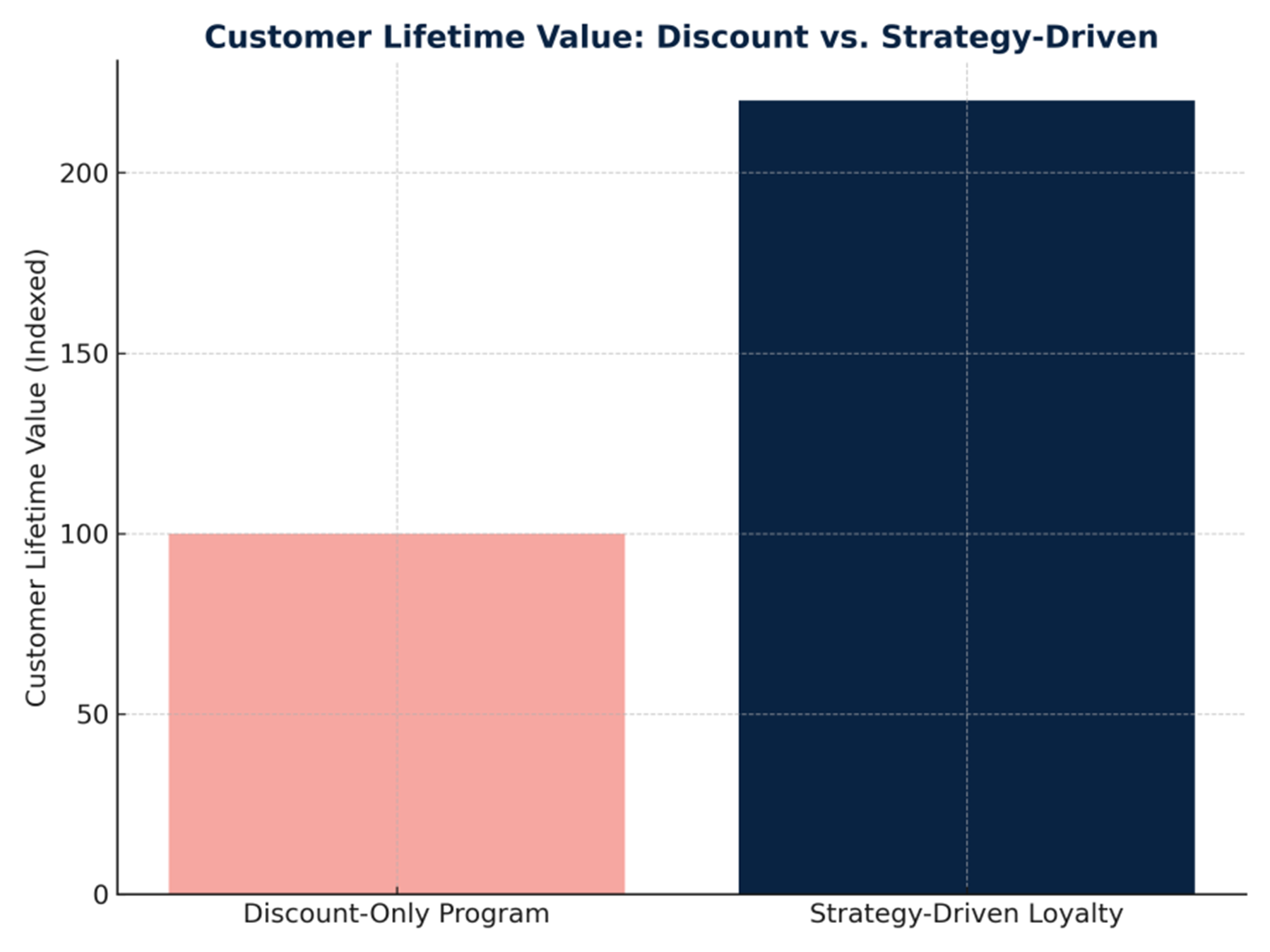

For dispensary operators, adding credit card acceptance is more than a convenience—it’s a growth catalyst. By reducing friction, increasing safety, and boosting customer loyalty, dispensaries can compete on equal footing with mainstream retailers while positioning themselves for sustainable long-term success.

Credit cards aren’t just a payment option—they are a strategic lever for unlocking profitability, scalability, and consumer trust in cannabis retail.